Geoff Green, President of Green Team Realty, welcomed everyone to the November 2020 Housing Market Update. The webinar, held on Tuesday, November 17 at 2 p.m. examined the housing market on both national and local levels.

If you missed the webinar or would like to view it again, it’s available here:

Meet the Panel:

Panelists included Keren Gonen and Barbara Tesa, of Green Team New Jersey Realty and Carol Buchanan, with Green Team New York Realty. Also joining the discussion were Ken Ford of Warwick Valley Financial Advisors, and Laura Moritz with Classic Mortgage LLC.

First, let’s talk about the economy

In January, the economy was strong, there were no signs of the housing market slowing down. It took a major global event to slow down a roaring economy.

So, what did people do with stimulus checks?

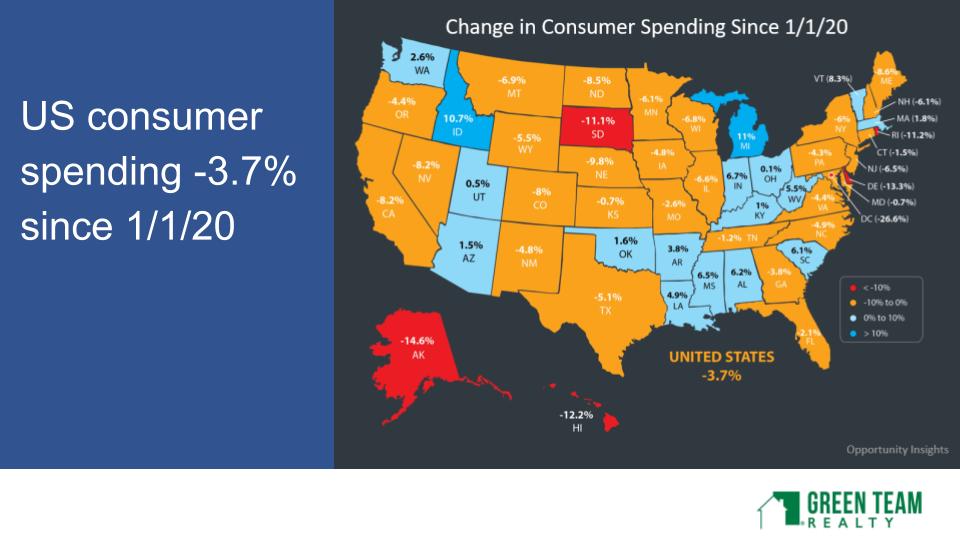

35% used it to pay down debts. 36% saved the money, and 29% spent the money. U.S. Consumer spending since January 1, 2020, is down by -3.7%. Changes in consumer spending by state is shown below:

Unemployment filings and benefits

Unemployment filings and benefits

Weekly unemployment filings have been steadily coming down. However, unemployment does remain at a high number. The number of people receiving unemployment benefits is also trending downwards.

Mortgage Forbearance, Home Inventory, Home Appreciation, and Mortgage Rates

The number of mortgages in active forbearance is decreasing dramatically. As of Oct 20, out of 2,397,000 families granted forbearance, some have extended it, However, 44% came out of the program while paying on time. In addition, 500,000 people paid off their mortgage.

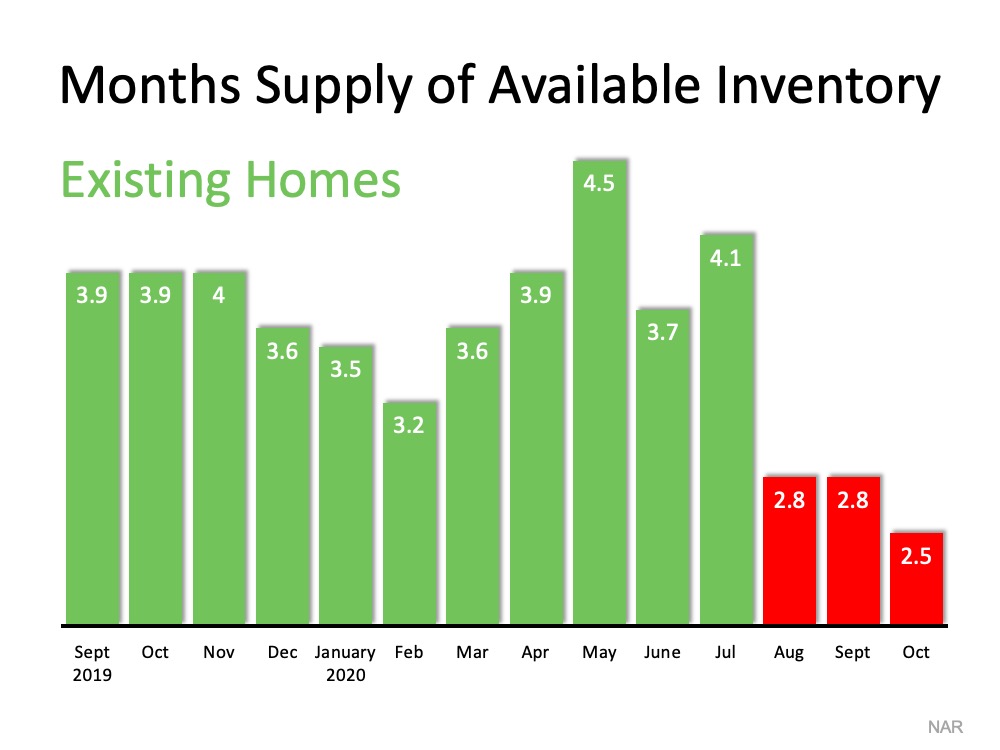

Moreover, stats show the decrease in inventory over the last 12 months. According to Zillow, the top reasons for people not putting their homes on the market now are financial uncertainty, uncertainty about life in general, and COVID-19 health concerns.

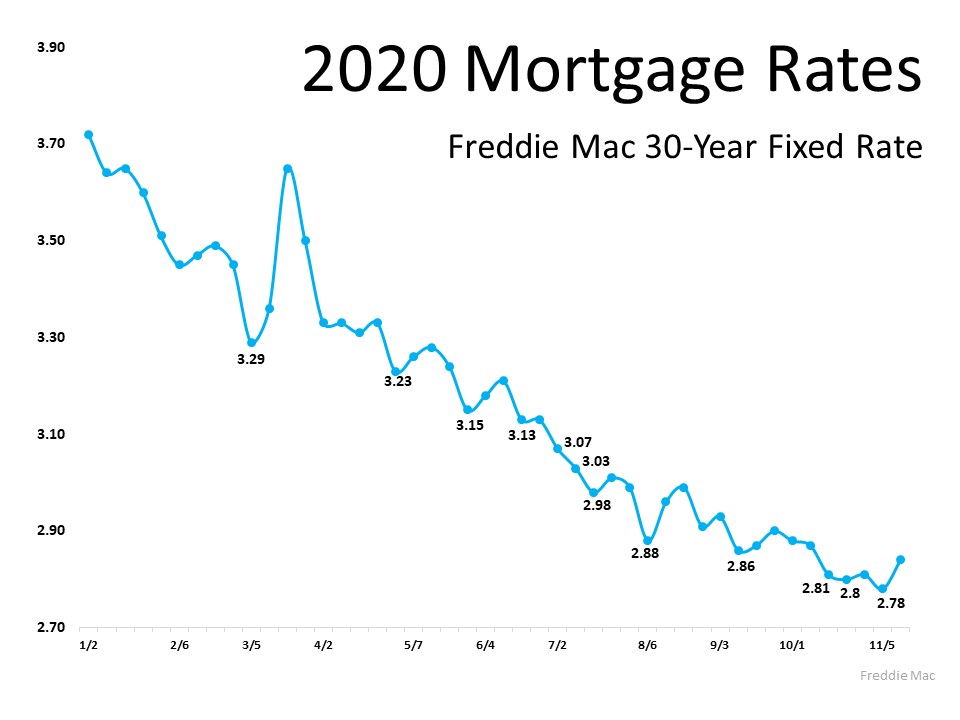

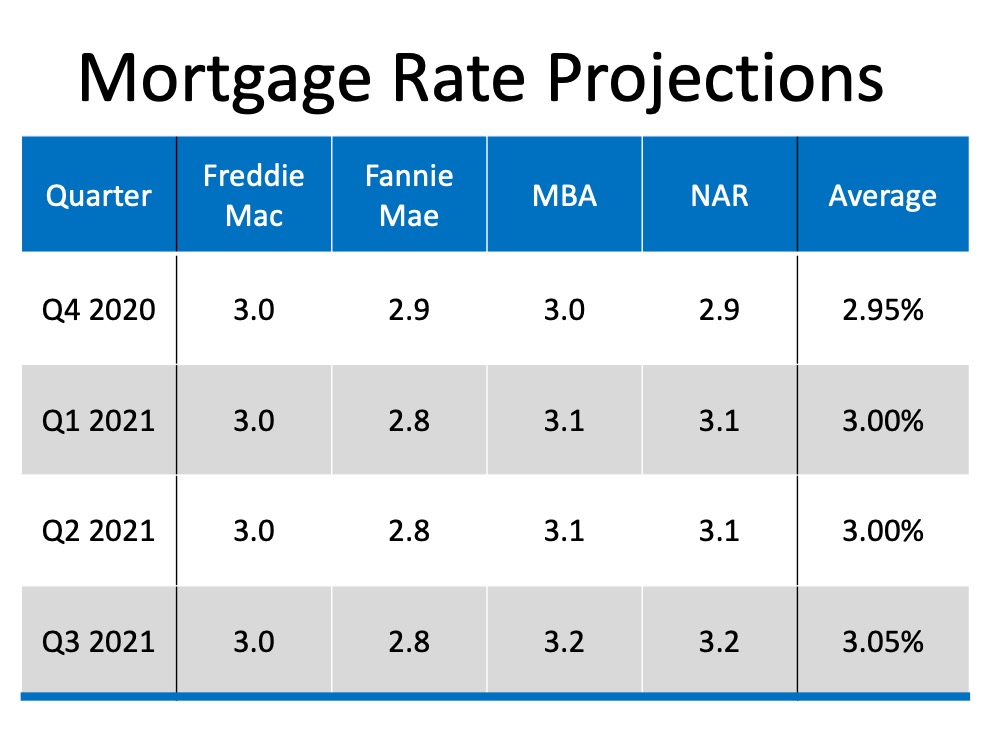

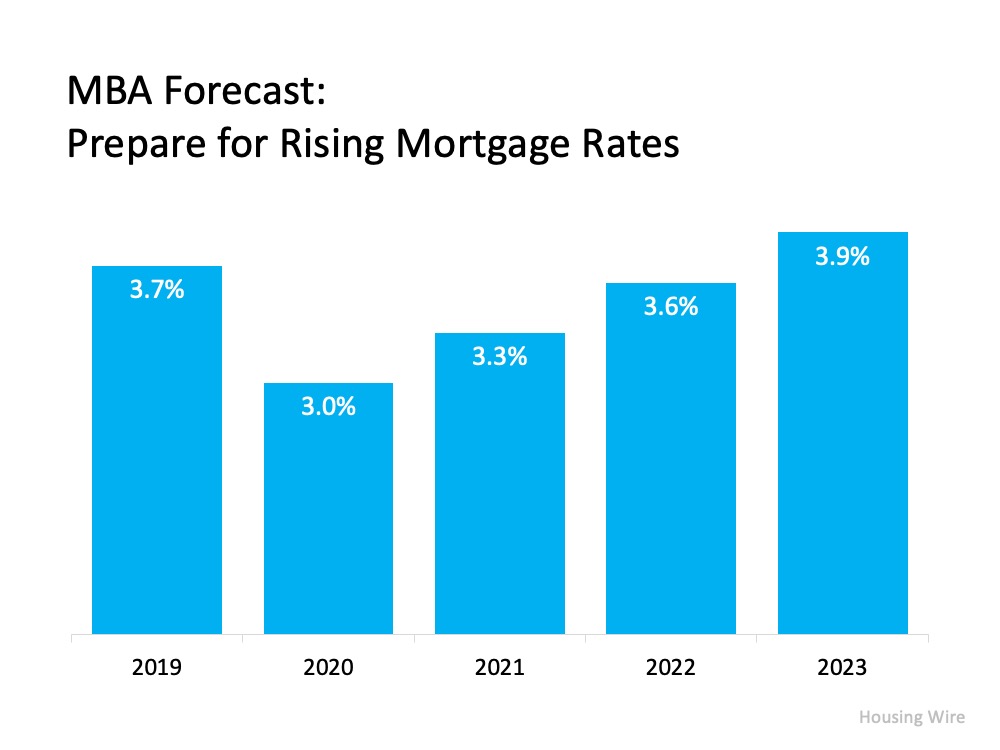

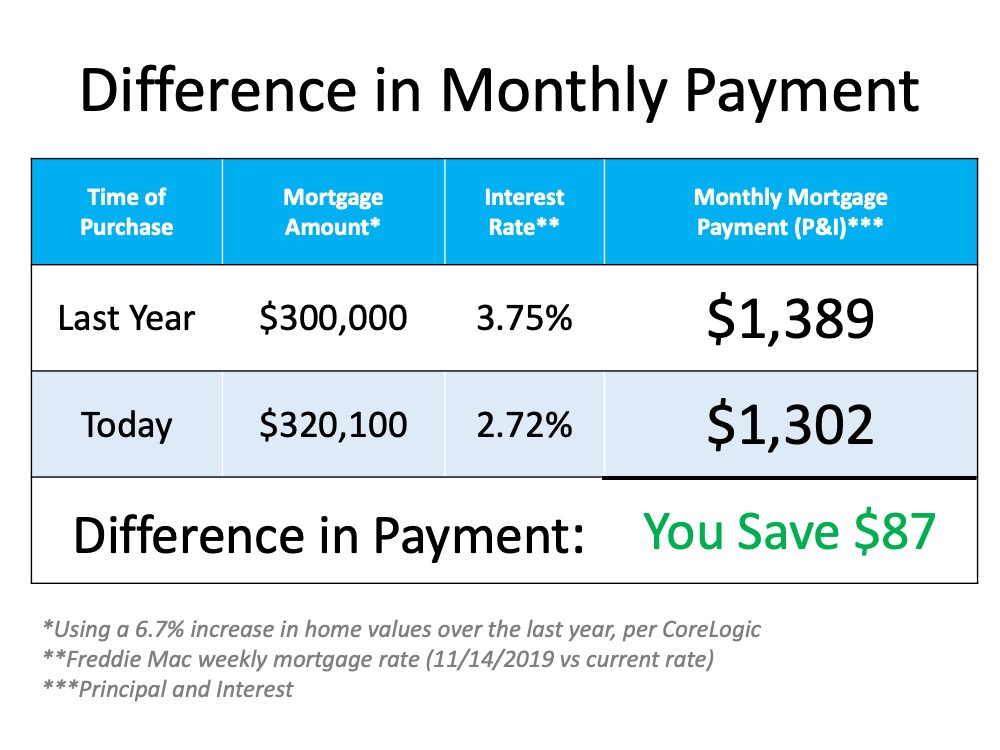

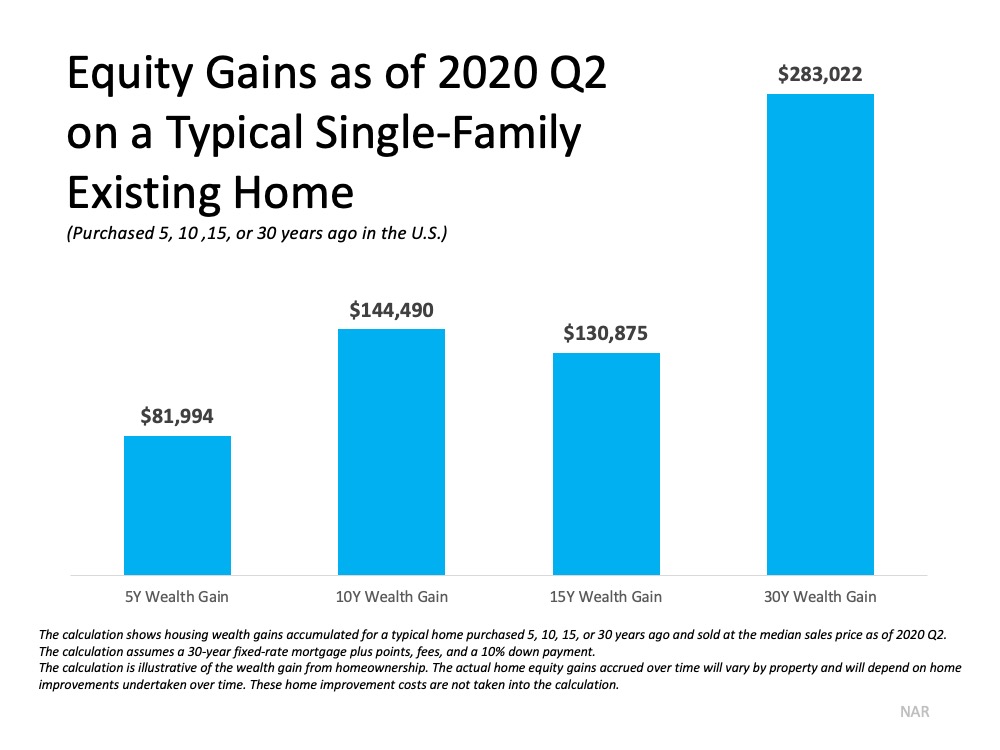

Most experts are bullish on home price appreciation. However, Mortgage Bankers’ Association is predicting rising mortgage rates over the next 3 years.

Learn more. Watch the Webinar.

For updates on what is happening in commercial real estate, the crisis facing renters at the end of moratoriums, and national and local market stats, click here.to watch the webinar. You’ll also be hearing from the sales associates, and financial and mortgage experts on what they are seeing in the market.

Furthermore, you can compare this month’s stats with those in the October Housing Market Update.

“Housekeeping” Items

Contact our Panelists

Join us for the last Housing Market Update of 2020 on Tuesday, December 15 at 2 p.m.

Sign up for updates now at GreenTeamRealty.com/HMU

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

“This is a big moment for a fantastic Realtor who has been trying to breakthrough in this industry. Karen is a can-do kind of person so it was only a matter of time before her big breakthrough moment came. Karen Gauvin is a name that will be at the top of the production charts for many years to come because she has done all the right things to get here. Karen has worked hard for her clients, always responding quickly, and always addressing their needs and concerns first. Karen’s willingness to continue to put the work in as a Realtor will prove to be the reason why she will be a perennial top producer. Congratulations Karen”

“This is a big moment for a fantastic Realtor who has been trying to breakthrough in this industry. Karen is a can-do kind of person so it was only a matter of time before her big breakthrough moment came. Karen Gauvin is a name that will be at the top of the production charts for many years to come because she has done all the right things to get here. Karen has worked hard for her clients, always responding quickly, and always addressing their needs and concerns first. Karen’s willingness to continue to put the work in as a Realtor will prove to be the reason why she will be a perennial top producer. Congratulations Karen”

![Tips to Sell Your House Safely Right Now [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/11/12090934/20201113-MEM-1046x1641.png)